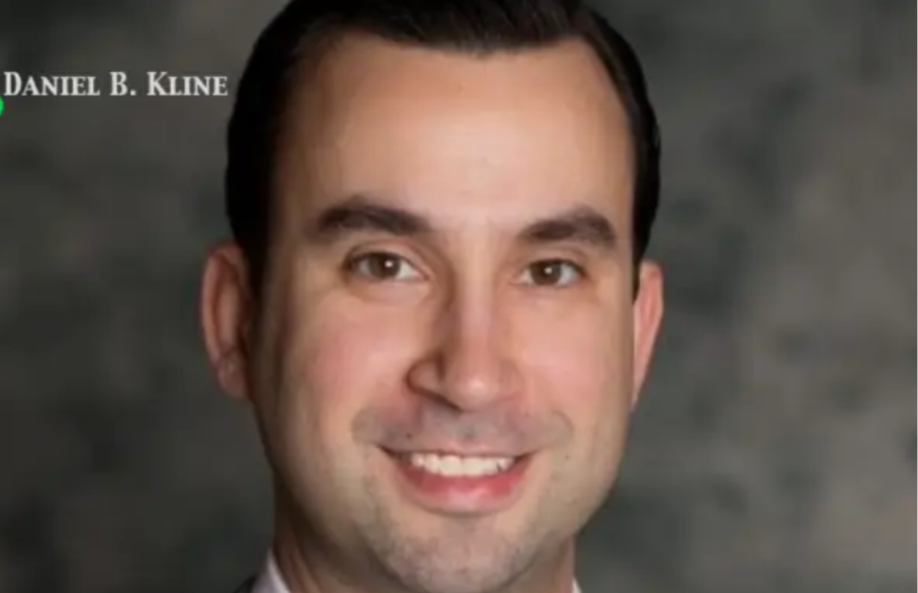

Daniel B. Kline: Exploring His Education, Career, Finances, and Life

Daniel B. Kline is a well-known figure in the business world, particularly in the realm of finance and stock analysis. As a contributor and analyst, Kline has made a significant impact on the way investors approach the market, providing insight into financial trends, stock picks, and business strategies. His journey into the world of finance and his influence on both aspiring and seasoned professionals is something worth exploring. Here, we dive into his background, education, career, and what finance enthusiasts, students, and professionals can learn from his experiences.

Education and Early Life

Daniel B. Kline’s educational background is rooted in a solid foundation in economics and business. He holds a degree in economics, which played a pivotal role in shaping his analytical approach to understanding market trends, economic shifts, and corporate strategies. His educational experiences gave him a comprehensive understanding of financial systems, which became essential for his career as a stock analyst and financial writer.

Though his early life remains relatively private, Kline’s education reflects a commitment to understanding complex financial markets. Like many professionals in his field, Kline recognized the importance of a strong academic foundation in economics, which has allowed him to interpret market data and apply strategic thinking to investments.

Career Path and Professional Achievements

Kline’s career is a testament to the power of critical thinking and strategic analysis in finance. He began his career in the stock analysis and financial writing fields, quickly building a reputation for his clear, insightful, and often contrarian views on market trends. His writing style, marked by a no-nonsense approach and a deep understanding of financial metrics, resonated with readers looking for sound advice in an often unpredictable market.

Throughout his career, Daniel B. Kline has worked with various financial outlets, contributing valuable articles, stock analysis, and commentary. His expertise has extended beyond just picking stocks to providing broader insights into economic trends, market cycles, and personal finance strategies. Kline has developed a reputation for carefully analyzing the potential of companies, particularly in the tech and AI sectors, where rapid growth often leads to significant investment opportunities.

One area where Kline has become particularly influential is in the field of stock picks, including high-growth companies such as Nvidia and the broader realm of AI stocks. His insights on these companies have helped investors understand their long-term potential, focusing on market positioning, technological advancements, and industry disruptions. For instance, Kline’s analysis of Nvidia stock has often emphasized the company’s leadership in the semiconductor and AI industries, underlining its role in powering the next generation of computing technologies.

Association in Business and Personal Life

Daniel B. Kline is not only a prominent voice in financial analysis but also a respected figure in the broader business community. His work with financial media outlets, such as The Motley Fool, has solidified his place in the world of business journalism. Through his articles, Kline has helped investors and businesses alike navigate the complex financial landscape, offering tips and insights that are both practical and forward-thinking.

His personal life and business ventures, while less publicized, align closely with his professional work. Kline’s deep involvement in financial analysis and stock trading is complemented by his commitment to understanding broader economic trends and their impact on business strategies. This integration of personal and professional knowledge has shaped his holistic approach to finance and investment.

What Finance Enthusiasts and Students Can Learn from Daniel B. Kline

For finance enthusiasts, students, and professionals in economics, accounting, and stock trading, Daniel B. Kline’s career offers valuable lessons in critical thinking, market analysis, and long-term investment strategies. Here are a few key takeaways:

- The Importance of Critical Thinking: Kline’s career underscores the need for critical thinking when analyzing stocks and market trends. By questioning assumptions and thoroughly researching companies, he exemplifies how to approach the stock market with a discerning eye, avoiding herd mentality.

- Comprehensive Understanding of Markets: Kline’s success in financial writing is due in part to his ability to look beyond the surface of market trends. Students and professionals can learn from his ability to assess economic data, industry shifts, and technological advancements to predict future opportunities.

- Focus on Long-Term Growth: Kline’s analysis often highlights companies with significant long-term potential, rather than focusing on short-term gains. For those entering the finance industry, this focus on sustainable growth and strategic investment is a valuable mindset to adopt.

- Understanding of High-Growth Sectors: Kline’s expertise in tech and AI stocks provides a strong example of how certain industries can transform the market. Finance students and professionals can benefit from his ability to spot these high-growth sectors early, enabling them to make informed investment decisions.

- Patience and Timing: One of the most important lessons Kline imparts is the value of patience and proper timing when investing. Whether discussing stocks like Nvidia or emerging technologies in AI, his approach emphasizes waiting for the right moment to invest and understanding when to hold or sell.

- Combining Data with Storytelling: In finance, raw data alone isn’t enough to inform decisions. Kline’s ability to weave together complex data with engaging storytelling helps investors grasp the bigger picture and make better-informed decisions.

One response to “Who is Daniel B. Kline? Discover the Secrets Behind His Winning Stock Picks and Financial Insights”

[…] Daniel B. Kline, an analyst at The Motley Fool, has also provided insight into various stocks, including RXRX stock. This biotech firm is closely watched for its innovative approach to personalized medicine and cancer treatments, which has garnered attention from investors looking to capitalize on the growing healthcare sector. Similarly, GEV stock has been highlighted due to its advancements in green energy technology, which aligns with the broader trend toward sustainable and renewable energy investments. […]