A Complete Guide to USDA One-Time Construction Loans and Construction Loan Calculators

For homebuyers seeking a cost-effective way to build a new home, the USDA construction loan program offers an excellent option. Whether you’re researching USDA one-time construction loans or exploring how a construction loan calculator works, this guide breaks down everything you need to know in detail.

USDA One-Time Construction Loan

The USDA One-Time Construction Loan is a unique financing product designed to streamline the process of building a home in eligible rural areas. This loan combines the construction financing and permanent mortgage into a single loan, eliminating the need for multiple closings. Here’s how it works:

- Eligibility Requirements:

- The property must be located in a USDA-eligible rural area.

- Applicants must meet income eligibility guidelines, which vary by location and household size.

- The home must be owner-occupied; investment properties are not eligible.

- Loan Features:

- No down payment required, as the loan offers 100% financing.

- Fixed interest rates for both the construction and permanent loan phases.

- Closing costs can often be included in the loan, reducing upfront expenses.

- Flexible terms allow for construction periods of up to 12 months.

- How It Works:

- Pre-Approval: Borrowers get pre-approved for the loan amount, ensuring they qualify for USDA requirements.

- Builder Selection: A USDA-approved builder must be selected to construct the home.

- Construction Phase: Funds are disbursed in stages to pay for construction costs as work progresses.

- Conversion: Once construction is complete, the loan transitions into a standard mortgage, eliminating the need for a second loan closing.

USDA Construction Loan

The USDA construction loan is similar to the one-time construction loan but typically requires separate closings for the construction loan and the permanent mortgage. Here are the key differences:

- Separate Closings:

- Borrowers must first secure a short-term construction loan to finance the building phase.

- Once construction is complete, a second loan closes, converting the financing into a permanent mortgage.

- Pros and Cons:

- Pros: Offers flexibility in terms of lenders and builders.

- Cons: Requires additional closing costs and underwriting, which may increase overall expenses.

- Common Use Cases:

- Ideal for borrowers who prefer to separate their financing or are working with a lender that does not offer one-time close options.

- Works well for more complex construction projects that may require additional customization.

What Is a Construction Loan Calculator?

A construction loan calculator is a financial tool that helps borrowers estimate the costs and monthly payments associated with construction loans. It accounts for various factors such as the loan amount, interest rate, construction period, and permanent loan terms.

Here’s a simplified formula to manually calculate your estimated payments:

Construction Loan Payment Formula

Permanent Loan Payment Formula

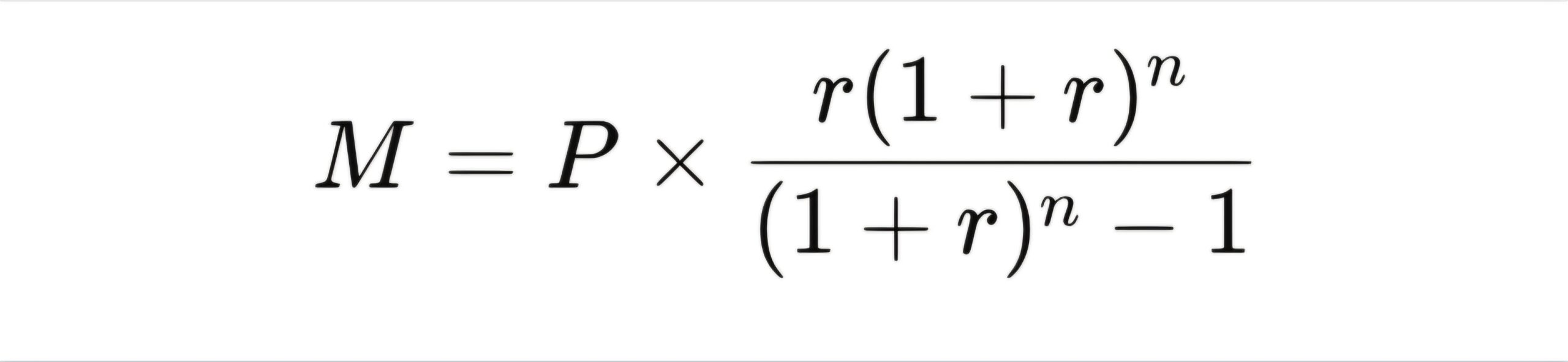

Once the loan converts to a permanent mortgage, calculate monthly payments using the amortization formula:

Where:

- MM: Monthly payment

- PP: Loan principal

- rr: Monthly interest rate (Annual Rate/12\text{Annual Rate} / 12)

- nn: Number of payments (Loan Term in Years×12\text{Loan Term in Years} \times 12)

Example Calculation

- Construction Phase Payment:

- Loan Amount: $300,000

- Interest Rate: 5%

- Time: 6 months

\text{Payment} = (300,000 \times 0.05 \times 6) / 12 = $7,500

- Permanent Loan Payment:

- Principal: $300,000

- Annual Interest Rate: 5%

- Term: 30 years

M = 300,000 \times \frac{0.004167(1+0.004167)^{360}}{(1+0.004167)^{360}-1} \approx $1,610.46

Using these formulas, borrowers can gain a clear understanding of their financial obligations during both phases of the construction loan.

By exploring USDA one-time construction loans, USDA construction loans, and the utility of a construction loan calculator, borrowers can make well-informed decisions about building their dream homes in eligible rural areas. Understanding these options and how to calculate costs manually ensures greater financial confidence in navigating the process.