Is Quick2Lend Legit? A Comprehensive Review

In today’s digital age, online lending platforms have become a popular alternative to traditional banks, offering quick and convenient access to funds. One such platform is Quick2Lend. This article examines the legitimacy of Quick2Lend, explores user reviews, and provides insights to help you make an informed decision.

What Is Quick2Lend?

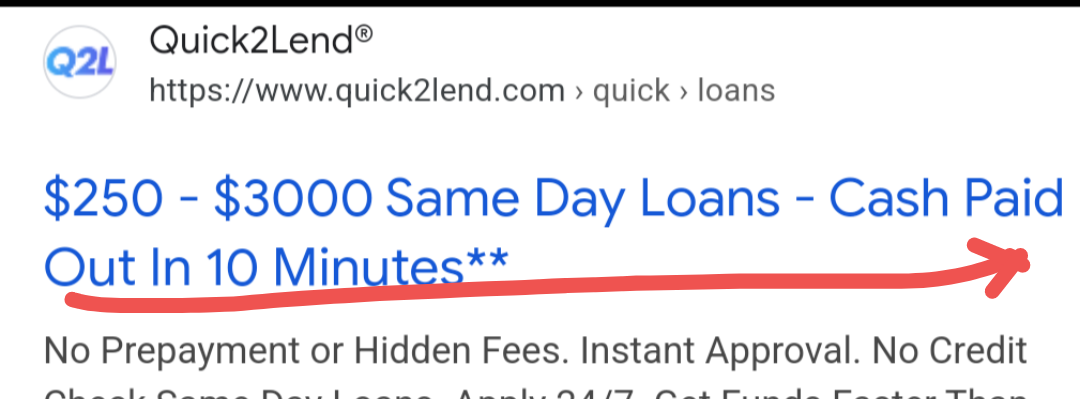

Quick2Lend is an online service that connects borrowers with a network of lenders, facilitating personal loans ranging from $250 to $3,000. The platform caters to individuals with various credit scores and offers loan terms between 3 to 36 months. Quick2Lend emphasizes a fast application process, with the potential for funds to be deposited directly into a borrower’s bank account in as little as 15 minutes.

Is Quick2Lend Legitimate?

Quick2Lend is a legitimate entity in the online lending space. It operates as a loan matching service, connecting borrowers with potential lenders. The platform is accredited by the Online Lenders Alliance (OLA), which promotes best practices in the online lending industry. This accreditation suggests that Quick2Lend adheres to industry standards and regulations.

Pros of Using Quick2Lend

- Wide Range of Lenders: By partnering with various lenders, Quick2Lend increases the likelihood of finding a loan that suits your specific needs.

- Fast Approval Process: The platform boasts quick approval times, with some users receiving loan offers within minutes.

- Inclusive Credit Consideration: Quick2Lend considers applicants with all types of credit histories, potentially offering opportunities to those with less-than-perfect credit.

Cons of Using Quick2Lend

- Credit Score Impact: While Quick2Lend accepts various credit scores, a lower credit score may result in higher interest rates on any loan offers received.

- Varying Lender Practices: As a loan aggregator, the terms and conditions, including fees and interest rates, can vary significantly between lenders. It’s crucial to review each offer carefully.

User Reviews and Experiences

User experiences with Quick2Lend appear to be mixed. Some users appreciate the swift and straightforward lending process, while others express concerns about high interest rates and limited flexibility in repayment terms. For instance, a Reddit user mentioned that Quick2Lend is a good option for a fast lending process but noted the high interest rates and limited repayment flexibility as drawbacks.

Tips for Using Quick2Lend

- Thoroughly Review Loan Offers: Carefully read the terms and conditions of any loan offer, paying close attention to interest rates, fees, and repayment schedules.

- Assess Your Financial Situation: Ensure that you can meet the repayment terms to avoid additional fees or negative impacts on your credit score.

- Verify Lender Legitimacy: While Quick2Lend connects you with lenders, it’s prudent to research the individual lender’s reputation and legitimacy.

Quick2Lend is a legitimate online loan matching service that offers a fast and convenient way to access personal loans. However,

potential borrowers should exercise due diligence by carefully reviewing loan terms and considering their financial situation before proceeding.

As with any financial decision, it’s essential to make informed choices that align with your financial goals and capabilities.

How Can You Reduce Your Total Loan Cost? Experts Reveal Proven Strategies!

How to Reduce Your Total Loan Cost

Reducing the overall cost of a loan is a crucial financial goal for many borrowers. Implementing effective strategies can lead to significant savings over the life of the loan. Consider the following approaches:

- Increase Your Credit Score: A higher credit score often qualifies borrowers for lower interest rates. Maintaining a strong credit history can make you eligible for more favorable loan terms. Experian

- Compare Lender Offers: Shopping around and comparing offers from multiple lenders can help identify the most competitive interest rates and terms, reducing the total loan cost.

- Set Up Autopay: Many lenders offer interest rate discounts to borrowers who enroll in automatic payments, which can lower the overall cost of the loan.

- Make Extra Payments: Contributing more than the minimum payment each month reduces the principal balance faster, decreasing the amount of interest paid over time.

- Refinance Your Loan: Refinancing to a loan with a lower interest rate or shorter term can lead to substantial savings, provided the new loan offers better terms than the existing one.

How to Qualify at a Loan Agency

Securing a loan from an agency requires meeting specific criteria. Prospective borrowers should consider the following factors to enhance their eligibility:

- Creditworthiness: A strong credit score and clean credit history are crucial, as they demonstrate reliability to lenders.

- Financial Stability: Proof of consistent income and employment history assures lenders of your ability to repay the loan.

- Collateral: For secured loans, providing valuable assets as collateral can improve approval chances.

- Debt-to-Income Ratio: Maintaining a low ratio indicates responsible debt management and increases loan eligibility.

- Comprehensive Documentation: Submitting complete and accurate financial documents, including tax returns and bank statements, facilitates the evaluation process.

Benefits of Obtaining a Personal Loan

Personal loans offer several advantages to borrowers, including:

- Debt Consolidation: Combining multiple debts into a single loan with a potentially lower interest rate simplifies payments and can reduce overall interest costs.

- Flexible Use of Funds: Personal loans can be used for various purposes, such as home improvements, medical expenses, or major purchases, providing financial flexibility.

- Fixed Interest Rates: Many personal loans come with fixed rates, ensuring consistent monthly payments and easier budgeting.

- No Collateral Required: Unsecured personal loans don’t require collateral, reducing risk to personal assets.

- Credit Score Improvement: Timely repayments can positively impact your credit score, enhancing future borrowing opportunities.

Understanding these aspects enables borrowers to make informed decisions, optimize loan benefits, and manage financial obligations effectively.