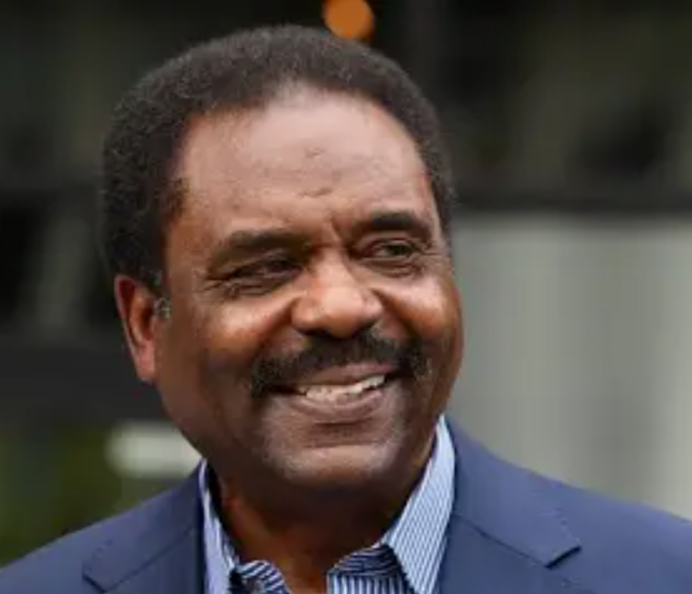

David Steward: Wealth-Building Strategies for Financial Freedom

David Steward, founder and chairman of World Wide Technology (WWT), exemplifies what it takes to achieve financial success and freedom. As one of America’s richest individuals and a trailblazer among Black entrepreneurs, Steward’s journey offers insights into wealth-building strategies, financial freedom planning, and actionable tips that anyone can apply.

This article explores how Steward built his fortune, the strategies he used, and lessons you can implement to accumulate wealth and achieve long-term success.

From Humble Beginnings to Building a Fortune

David Steward was born in 1951 in Chicago and raised in Clinton, Missouri, during an era of segregation and economic hardship. Despite systemic challenges, he developed a strong work ethic and resilience that would later propel his success.

Steward graduated from Central Missouri State University in 1973 with a Bachelor of Science in Business Administration. Early in his career, he held various roles, including production manager and senior account executive, before taking a bold step toward entrepreneurship.

World Wide Technology: A Case Study in Wealth-Building

In 1990, Steward founded World Wide Technology with a vision to provide enterprise IT solutions. What started as a small operation grew into a global leader in systems integration and supply chain solutions. Today, WWT generates over $17 billion in annual revenue and employs more than 8,000 people worldwide.

Key Factors Behind WWT’s Success

- Customer-Centric Approach: Steward focused on delivering tailored solutions that meet client needs.

- Continuous Innovation: The company invested in emerging technologies to stay competitive.

- Strategic Leadership: Steward built a strong management team and prioritized employee engagement.

By leveraging these wealth-building strategies, Steward turned WWT into a multibillion-dollar enterprise, establishing himself as a Black American billionaire.

Wealth-Building Strategies from David Steward

David Steward’s approach to building wealth aligns with proven financial freedom planning principles. Here are the core strategies that contributed to his success.

1. Focus on Financial Education

Understanding the principles of wealth creation is critical. Steward’s success demonstrates the importance of financial education, including:

- Learning the Basics: Budgeting, saving, and investing form the foundation of wealth management.

- Understanding Risk: Steward took calculated risks in launching WWT, a principle applicable to investments or starting a business.

- Adapting to Change: Staying informed about economic trends and opportunities ensures long-term growth.

2. Develop Multiple Income Streams

Steward’s business model highlights the importance of diversification. Whether through multiple income streams or expanding service offerings, diversification mitigates risks and maximizes earnings. Apply this by:

- Starting a side hustle or small business.

- Investing in dividend-paying stocks.

- Exploring real estate opportunities for rental income.

3. Invest for Growth

Steward reinvested profits into scaling his business and exploring new markets. For individuals, this principle translates to:

- Building a Retirement Portfolio: Contribute to 401(k) accounts or IRAs.

- Using Compound Interest: Start investing early to maximize long-term gains.

- Balancing Risk and Reward: Diversify investments to include both growth stocks and stable assets.

4. Adopt a Long-Term Mindset

Wealth-building requires patience and consistency. Steward didn’t achieve success overnight, and neither will most individuals. By focusing on long-term goals, you can avoid impulsive decisions and stay committed to your financial freedom planning.

Tips for Financial Freedom Planning

Achieving financial freedom involves more than just earning money; it requires managing and growing it wisely. Here are practical tips inspired by Steward’s journey:

Create a Budget

A well-organized budget helps you allocate resources effectively. Use the 50/30/20 rule—spending 50% on needs, 30% on wants, and saving or investing 20%. Steward likely followed a disciplined approach to managing WWT’s finances, a principle that applies to personal wealth as well.

Manage Debt Wisely

High-interest debt can derail wealth-building efforts. Pay off credit cards and personal loans first while maintaining manageable levels of “good debt” such as mortgages or student loans.

Insure Your Wealth

Protecting what you’ve built is crucial. Invest in health, life, and disability insurance to guard against unforeseen setbacks, ensuring your path to financial freedom remains uninterrupted.

Lessons from David Steward’s Wealth-Building Journey

David Steward’s rise to wealth provides valuable lessons for anyone aspiring to achieve financial independence:

- Resilience Matters: Overcoming adversity shaped Steward’s character and work ethic.

- Calculated Risks Pay Off: Starting WWT in a competitive market was risky, but Steward’s thorough planning ensured success.

- Investing in People Yields Results: Steward fostered strong relationships with employees and clients, contributing to WWT’s growth.

- Generosity is Key: Steward’s philanthropic efforts remind us that wealth isn’t just about accumulation—it’s about making a positive impact.

Incorporating Wealth-Building Strategies in Your Life

You don’t need to be a billionaire to apply Steward’s strategies. Here’s how you can start:

- Set Clear Goals: Define your version of financial freedom, whether it’s retiring early, owning a home, or traveling the world.

- Invest Consistently: Even small, regular contributions to index funds or ETFs can grow significantly over time.

- Diversify Income Sources: Explore opportunities like freelancing, real estate, or passive income investments.

- Stay Educated: Continuously learn about personal finance to make informed decisions.

Conclusion

David Steward’s journey from humble beginnings to becoming a Black American billionaire is a testament to perseverance, innovation, and strategic wealth-building. By focusing on financial education, taking calculated risks, and adopting long-term strategies, Steward created a legacy of success.

For those inspired by Steward’s story, the path to wealth starts with actionable steps like financial freedom planning, investing wisely, and building multiple income streams. Whether your goal is to grow a business, secure your family’s future, or achieve financial independence, Steward’s principles serve as a roadmap for success.

Start today by embracing the wealth-building strategies that align with your goals, and take the first step toward financial freedom.