In today’s financial landscape, understanding your credit is essential to making informed decisions about loans, mortgages, and credit cards. With a wealth of credit-related services available, consumers are often left wondering which platform to trust and how often their information is updated. This comprehensive guide compares some of the leading credit monitoring services: Credit Karma, Experian, TransUnion, and Equifax. We’ll explore their features, how often they update your credit report, and the value each service offers to ensure you make the best decision for your financial health.

Credit Karma: A Powerful Tool for Monitoring Your Financial Health

Credit Karma is one of the most well-known platforms offering free credit scores, credit reports, and credit monitoring. But how does it stack up against its competitors, and what sets it apart in the world of credit services?

How Often Does Credit Karma Update?

Credit Karma updates its credit scores and reports once a week, offering you the opportunity to keep a close eye on any changes to your financial standing. However, while your Credit Karma credit score is updated regularly, it’s important to note that the scores shown on the platform are based on your VantageScore 3.0 model, which may not match the score used by lenders (who often rely on FICO scores). This means your Credit Karma score may differ slightly from the one you see in a loan application, but it still provides a good indication of your overall credit health.

Credit Karma Net Worth: An Added Feature

In addition to credit scores, Credit Karma offers a net worth calculator that pulls in data from your credit accounts and assets. This feature helps you understand your financial standing and can guide you in making smarter decisions about saving, spending, and investing.

Credit Karma Loans and Settlement Payouts

Credit Karma also offers tools to help you find personal loans and settlement payout offers for outstanding debts. While these features can be incredibly useful, it’s important to remember that Credit Karma loans are not directly provided by the platform. Instead, Credit Karma connects users with lenders, offering loan suggestions based on your credit profile.

For those looking to pay down debt, Credit Karma also provides information on debt settlement programs. While these can sometimes offer significant relief, it’s essential to fully understand the implications and fees associated with settlement services before proceeding.

Credit Karma vs. Experian: A Comparison of Key Features

While both Credit Karma and Experian offer credit monitoring, there are a few key differences worth noting. Experian is one of the three major credit bureaus, which means it offers credit reports directly from the source. On the other hand, Credit Karma pulls data from TransUnion and Equifax, two other credit bureaus.

Experian, however, offers a more robust and complete view of your credit profile, as it includes detailed credit reports. Credit Karma, while helpful, only provides partial credit reports and focuses mainly on offering credit scores.

Experian: A Trusted Name in Credit Monitoring and Identity Protection

As one of the three major credit bureaus, Experian plays a crucial role in the credit reporting ecosystem. Known for its accuracy and reliability, Experian offers a wealth of services, from credit monitoring to identity theft protection.

Is Experian Safe?

When it comes to safety, Experian is a trusted brand with a long-standing reputation for protecting your credit information. Experian uses bank-level encryption and security measures to safeguard your personal data, ensuring it is protected from cyber threats. Experian also offers identity theft protection and fraud alerts, which can help you stay on top of any suspicious activity in your financial accounts.

Experian Verify: A Step-by-Step Security Process

Experian Verify is an important tool used for identity verification. When you apply for credit or open new accounts, Experian’s verification process helps prevent fraud by confirming your identity through security questions or biometric data, adding an extra layer of protection against unauthorized access.

How Often Does Experian Update Your Credit Report?

Experian updates your credit report every 30 days, providing a fresh snapshot of your credit health. This is a slightly less frequent update than Credit Karma’s weekly refresh, but it’s still quite useful for tracking major changes to your credit standing.

TransUnion: Key Features and Updates

Like Experian and Equifax, TransUnion is one of the major credit bureaus, offering essential services to consumers.

TransUnion Credit Cards: What You Should Know

Many credit cards use TransUnion as a data source when assessing your creditworthiness. If you’re looking to understand how your credit score is being evaluated, it’s helpful to monitor TransUnion’s reports regularly. This can give you insight into how your credit card applications might be processed and which factors lenders are considering.

When Does TransUnion Update?

TransUnion updates its credit reports once a month, ensuring that any changes in your financial situation are reflected in your credit score. This allows users to track their credit report’s progress and make informed decisions about their credit health.

Equifax: Protecting Your Credit and Identity

Equifax is another major credit bureau with a reputation for offering comprehensive credit monitoring and identity protection services.

Equifax Breach Settlement: What You Need to Know

Equifax was the subject of a massive data breach in 2017, affecting millions of consumers’ personal information. As a result, Equifax set up a settlement offering financial compensation for affected individuals. The amount of the payout varies, but affected individuals could receive up to $125, or more if they experienced documented losses due to the breach.

Equifax Alert Text and Spam: How to Handle It

Equifax provides alert text messages to notify you of any changes to your credit report. While these alerts can be incredibly useful, it’s important to be aware of potential spam messages. If you receive an unsolicited alert or message that seems suspicious, avoid clicking on links and verify it directly through your Equifax account.

Does Equifax Have an App?

Yes, Equifax offers a mobile app that allows users to track their credit scores, review credit reports, and manage alerts directly from their smartphones. This convenience makes it easier to stay on top of your credit health while on the go.

The Role of All Three Credit Bureaus: Equifax, Experian, and TransUnion

The three major credit bureaus—Equifax, Experian, and TransUnion—are legally required to provide identical information regarding your credit history. This means that any major changes to your credit score or report should be reflected across all three platforms. However, due to differences in the way each bureau collects and reports data, your credit scores may differ slightly from one bureau to another.

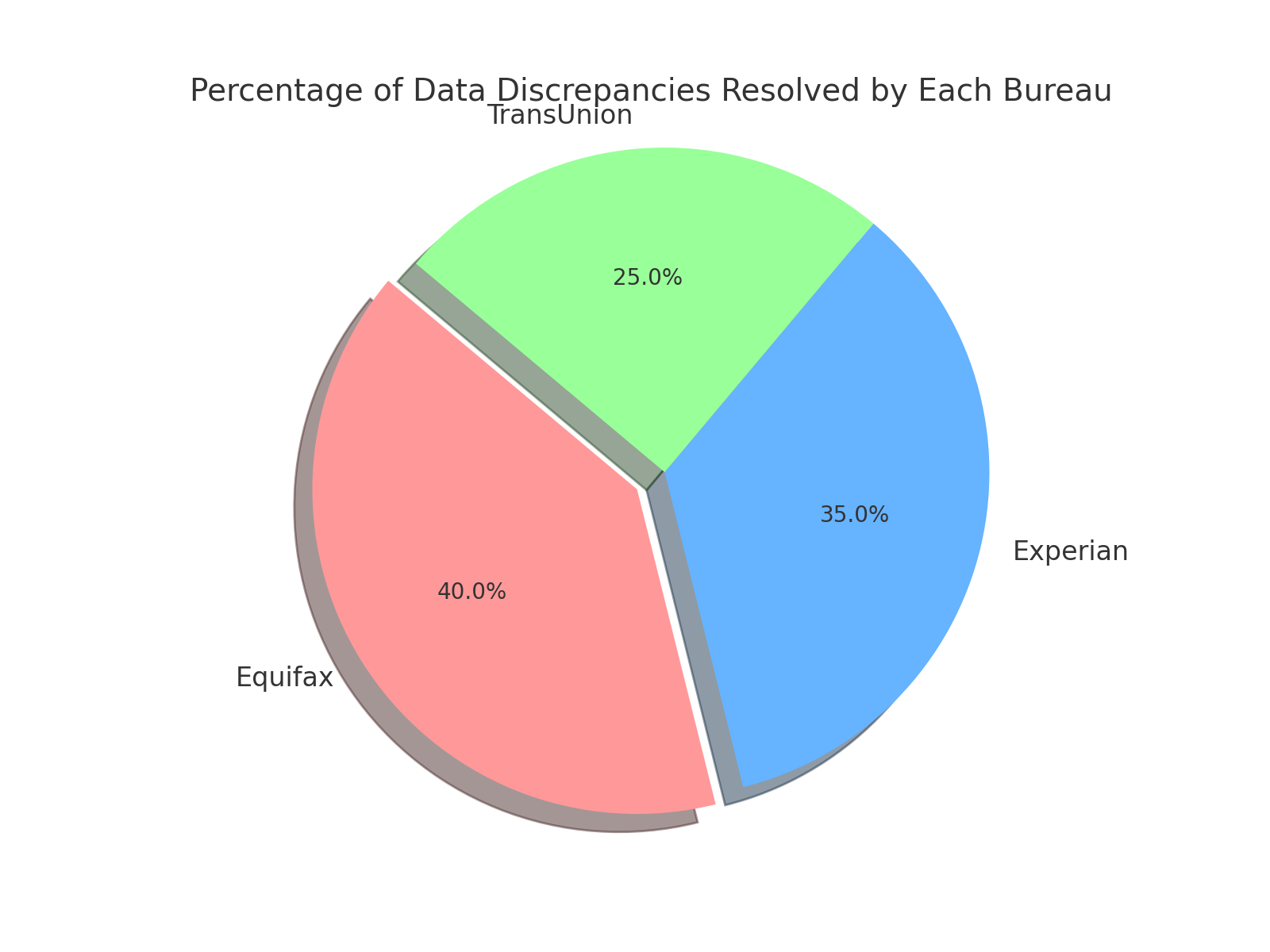

To visualize this data, a pie chart below illustrates the percentage of data discrepancies resolved by consumers across the three bureaus.